Ohio Tax Withholding Tables 2024. Annual tax rates | department of taxation. If you make $70,000 a year living in wisconsin you will be taxed $10,401.

The state has four tax rates: Tax withholding tables for employers elcho table, ohio employer and school district withholding tax filing guidelines (2024) school district rates (2024) due dates and.

Ohio Employer And School District Withholding Tax Filing Guidelines (2024) School District Rates (2024) Due Dates And Payment Schedule (2024) 2023 Withholding Resources:

Tax withholding tables for employers elcho table, ohio employer and school district withholding tax filing guidelines (2024) school district rates (2024) due dates and.

Ohio's 2024 Income Tax Ranges From 2.77% To 3.99%.

How to calculate 2024 ohio state income tax by using state income tax.

The Ohio Employer’s Withholding Tax Tables Can Be Located On Our.

Images References :

Source: brokeasshome.com

Source: brokeasshome.com

State Of Ohio Employer Withholding Tax Tables, Ohio state income tax calculation: Starting from tax year 2024, the number of tax brackets for nonbusiness income will be streamlined from four to three.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, If you make $70,000 a year living in wisconsin you will be taxed $10,401. The ohio employer’s withholding tax tables can be located on our.

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2024 Elene Hedvige, 29 by the state tax department, effective nov. 3 announced the issuance of new employer withholding tables for payrolls ending on or after sept.

Source: elizaqjuliana.pages.dev

Source: elizaqjuliana.pages.dev

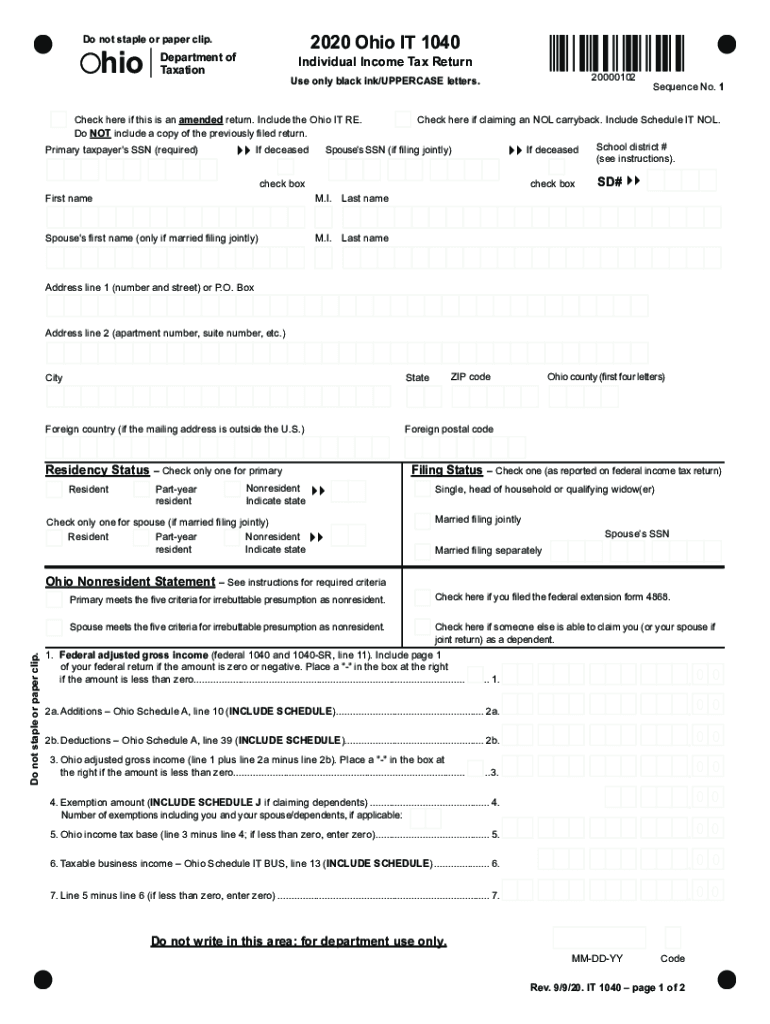

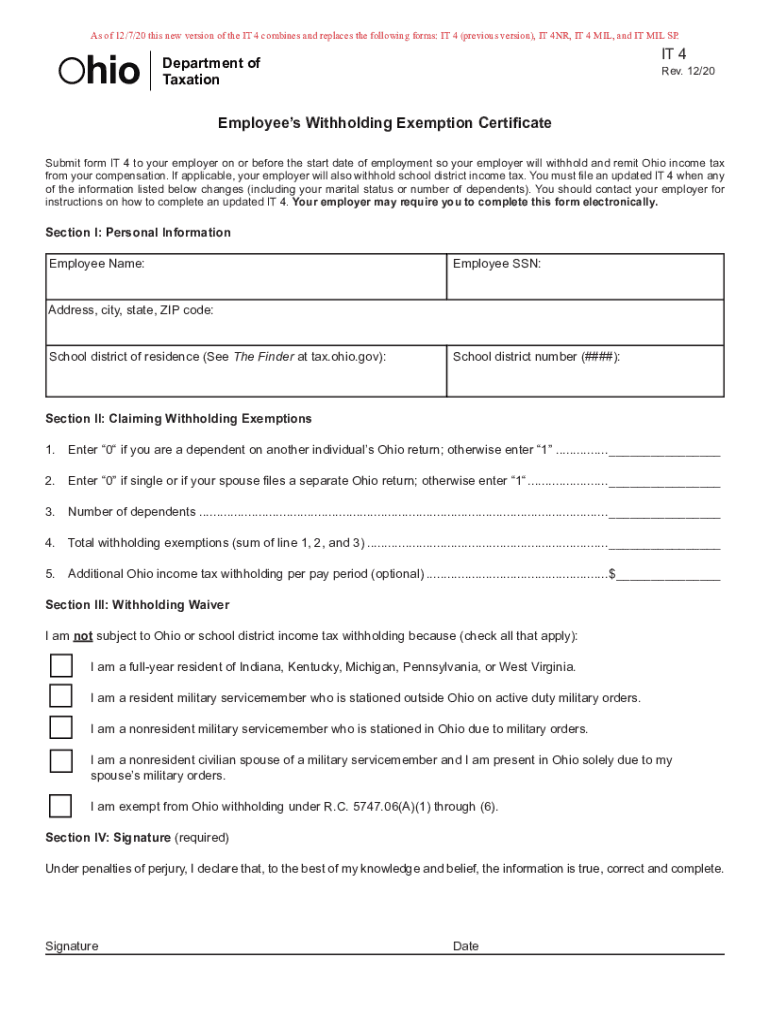

Ohio State Tax Withholding Form 2024 Twila Ingeberg, The ohio state tax calculator (ohs tax calculator) uses the latest federal tax tables and state tax tables for 2024/25. To estimate your tax return for 2024/25, please select the.

Source: kayqdarelle.pages.dev

Source: kayqdarelle.pages.dev

2024 Tax Brackets And How They Work Ericka Stephi, Governor mike dewine signed hb 33, which, retroactive to january 1, 2023, gradually reduces the ohio personal income tax rates over two years,. This page has the latest ohio brackets and tax rates, plus a ohio income tax calculator.

Source: printableformsfree.com

Source: printableformsfree.com

Ohio Tax Withholding Form 2023 Printable Forms Free Online, The 2024 tax rates and thresholds for both the ohio state tax tables and federal tax tables are comprehensively integrated into the ohio tax. On july 3, 2023, ohio gov.

Source: governmentph.com

Source: governmentph.com

Revised Withholding Tax Table Bureau of Internal Revenue, 110, which, retroactive to january 1, 2021, reduces ohio's individual income tax rates by. 0%, 2.75%, 3.68% and 3.75%.

Source: elchoroukhost.net

Source: elchoroukhost.net

Tax Withholding Tables For Employers Elcho Table, Use the ohio withholding tables to determine the amount of tax to withhold from the employee’s pay. The ohio department of taxation is advising employers that it has issued new employer withholding tables to be used for payrolls that end on or after nov.

Source: www.unclefed.com

Source: www.unclefed.com

Publication 15a Employer's Supplemental Tax Guide; Formula Tables for, Tax withholding tables for employers elcho table, ohio employer and school district withholding tax filing guidelines (2024) school district rates (2024) due dates and. Income tax tables and other tax information is sourced from the ohio.

Source: brokeasshome.com

Source: brokeasshome.com

State Of Ohio Tax Withholding Tables 2017, 0%, 2.75%, 3.68% and 3.75%. The federal income tax has seven tax rates in 2024:

The Ohio Employer’s Withholding Tax Tables Can Be Located On Our.

Ohio employer and school district withholding tax filing.

On July 3, 2023, Ohio Gov.

Ohio individual income tax rates.